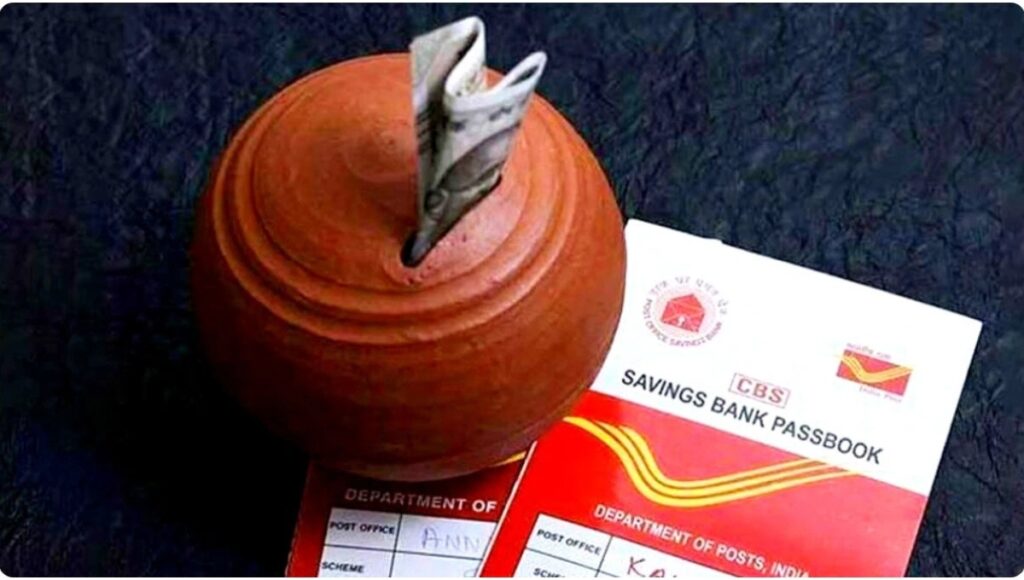

RD scheme: Have you ever thought that you can create a fund of lakhs with monthly savings of just ₹5000? Yes, if you want a financially strong and secure future in 2025, then this is the time to take the right step. A popular scheme like fixed deposit is RD i.e. Recurring Deposit which turns your small investments into a strong capital over time. This scheme is ideal for those who want to fulfill big dreams in the future by investing small amounts regularly – be it children’s education, buying a house or creating an emergency fund.

Why is RD plan the best option to invest in 2025

In today’s time when risky investment options are available in the market, RD plan is a medium that gives guaranteed returns without any fluctuations. This scheme is specially designed for those people who want to create a fixed fund by saving a fixed amount every month. In this, the interest rate is fixed in advance, so that the investor knows from the very first day how much amount he will get on maturity.

Invest ₹5000 per month and get more than ₹3.56 lakh in 5 years

If you invest ₹5000 every month regularly, then in just 5 years you can create a strong fund of about ₹3.56 lakh. In this amount, your total investment will be ₹3 lakh and the remaining ₹56,000 will be added as interest. You will get this benefit from a safe and stable option instead of any risky investment, which also gives peace of mind.

Safe investment, fixed benefit: Main benefits of RD plan

RD i.e. Recurring Deposit Scheme is protected by the bank, due to which your money is completely safe. Its biggest feature is that you get fixed returns at a fixed interest rate as per time. Apart from this, this scheme also gives you the benefit of tax savings and promotes the habit of investing from time to time. This plan teaches financial discipline, which later becomes the basis of big savings and wealth creation.[Related-Posts]

Interest rates and maturity amount: Understand the complete calculation

If you invest ₹ 5000 per month for 5 years and the interest rate is considered to be 6% per annum, then the total maturity amount will be more than ₹ 3.56 lakh. If you make the same investment for 6 years, then this amount can reach ₹ 3.78 lakh. These figures show that even savings made gradually become big with time, all you need is a right plan.

RD scheme can become the foundation of your dreams

Everyone dreams of giving good education to their children, living in their own house or being financially independent in old age. RD plan can help you make these dreams come true. This plan is not just a financial option, but a safety shield for life that turns your hard work today into a smile tomorrow.

Disclaimer: This article has been prepared for information and awareness purposes only. The interest rates and rules of RD scheme may change according to the bank or post office. Before investing, be sure to get complete information from the concerned institution. This article should not be taken as an investment advice, please seek guidance from your financial advisor.